Your Comprehensive Risk Security Platform

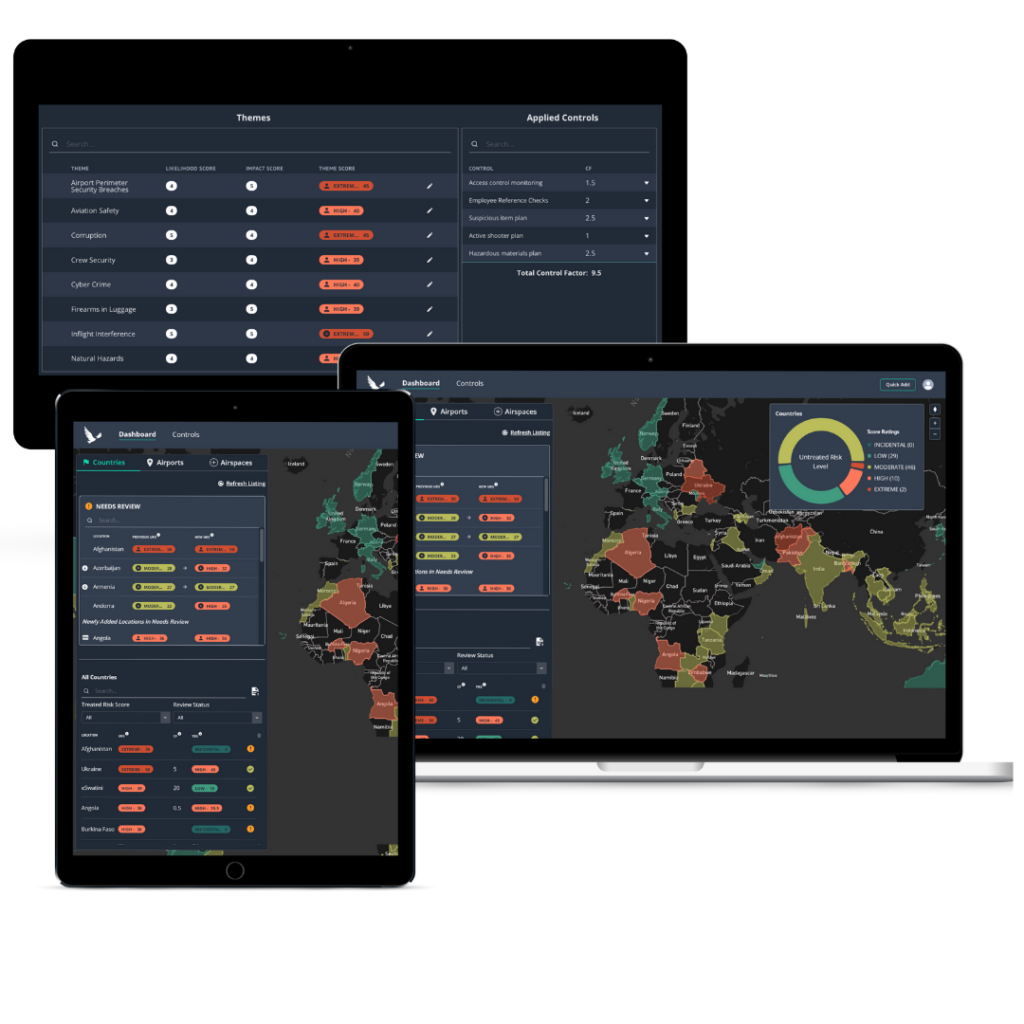

Introducing Osprey Risk Manager, a robust risk management solution designed with the aviation industry, for the aviation industry. The platform offers unparalleled capabilities and customisation with features such as customisable automated reporting, enabling the creation of tailored report templates for diverse use cases.

The platform automates all the necessary workflows, helping you to achieve effective, compliant, and efficient risk management. With the capability to visualise both untreated and treated risk ratings as mitigations are applied, Osprey provides a comprehensive overview of risk evolution. Additionally, users can set manual sensitivity scores to notifications and alerts, ensuring a focus on data specifically pertinent to their operational needs.

Achieve a centralised, comprehensive risk management process to maintain accurate reports and risk prioritisation.

Key Industry Challenges

Key themes and challenges that we are discussing in the aviation industry, shaping the continuous innovation of Risk Manager.

COMPLEX AND TIMELY PROCESSES

ACCOUNTABILITY AND COMMUNICATION

MITIGATION AND MONITORING

Capabilities & Benefits

The Osprey Risk Manager platform offers you an all-in-one solution to risk management.

CONSOLIDATES DATA FROM MULTIPLE SOURCES

The platform amalgamates all your risk data into one place, generating a single source of truth.

INTERNAL CONTROLS MANAGEMENT

Control measures for risk can be monitored and reviewed internally, in one single platform.

CUSTOMISABLE DOCUMENTATION AND REPORTS

One click access to customised reports for updating interested senior stakeholders and audit purposes.

AUTOMATED ALERTS AND NOTIFICATIONS

Instant notifications at the point change occurs, allowing you to proactively monitor and manage risk

COMPREHENSIVE RISK IDENTIFICATION

Utilise the world's largest aviation-specific risk database to identify operational risks efficiently.

REGULATORY AND STANDARDS-BASED COMPLIANCE SUPPORT

From identification to mitigation, you can make sure your operations are ISO31000 compliant.

Trusted by Our Clients

Achieve a centralised, comprehensive risk management process

Elevate your risk management practices with an all-in-one solution today

The platform now has Riskline Data Scores available to you as standard